Mastering Inventory: The Last In First Out (LIFO) Method Explained

30 Jan 2025

|by diadmin

Last in first out (LIFO) is an inventory method where the latest items bought are sold first. This article explains how LIFO works, its impact on financials, and compares it with other methods like FIFO.

Key Takeaways

- The Last In First Out (LIFO) method prioritizes the sale of the most recently purchased inventory, impacting financial statements by increasing the cost of goods sold (COGS) during inflation, resulting in lower net income and tax liabilities.

- LIFO results in outdated inventory valuations on balance sheets, potentially misrepresenting asset value and financial position, which differs from the First In First Out (FIFO) method that typically reflects higher inventory values.

- Utilizing technology such as inventory management software can enhance the efficiency and accuracy of LIFO accounting, enabling businesses to align their costs with current market conditions while managing financial performance effectively.

Understanding the Last In First Out (LIFO) Method

The inventory valuation method known as Last In, First Out (LIFO) employs a principle that prioritizes the selling of the most recently bought items first. Consequently, under LIFO, the cost attributed to goods sold is based on newer stock prices, leaving older merchandise recorded on the balance sheet. This particular strategy is widely adopted in regions such as America and tends to be preferred by retailers and entities facing escalating costs associated with their inventories among several inventory costing methods.

By presuming that inventory last acquired is also the first sold off (last in, first out), this practice substantially impacts an organization’s financial statements during times of inflation by elevating COGS. Such an increase leads to lesser taxable earnings and net income due to higher deducted expenses related to sales. In scenarios where price levels are increasing gradually over time, with inflated purchase costs for fresh supplies matching up against ongoing revenues often resulting in diminished profits. Simultaneously, it reduces taxation commitments.

Although utilizing LIFO can mean less tax burden through increased cost of goods sold figures reflecting more recent purchases at elevated rates, which keeps older stocks listed at prior lower prices within assets—thereby presenting dated valuations—it could misconstrue true asset values on company records.

Aligning steeper expenditures from new acquisitions alongside present-day revenue streams positions LIFO as a beneficial instrument for firms navigating economic environments marked by rising inflationary trends.

How LIFO Impacts Financial Reporting

The employment of LIFO accounting methods has a considerable effect on financial reporting, commonly leading to an elevated cost of goods sold (COGS) when inflation is present. As the more expensive recently acquired inventory gets utilized first under this method, there’s usually a decline in reported net income. This scenario influences earnings declarations to investors and simultaneously reduces taxable income, which can improve cash flow.

In relation to the balance sheet, LIFO methodology may result in carrying values for inventory that do not align with current market prices due to using older stock figures. Thus potentially obscuring true asset worth and painting an imprecise picture of company finances. Regarding the income statement impact, increased COGS translates into diminished gross profit as well as lowered net profits—a matter that might disconcert shareholders and affect how stocks are seen in financial markets.

Considering other inventory valuation methods alongside LIFO reveals differences within financial statements—especially compared with FIFO systems where profits tend to show higher due largely because it assumes earlier cheaper purchases are sold first. Although during times of rising costs LIFO better matches expenses against revenue by considering recent purchase prices—even if resulting lower reported profits—it poses a significant decision point for businesses prioritizing cost management amid inflationary pressures.

Choosing between various inventory valuation techniques like FIFO or others requires companies to delicately evaluate their unique fiscal circumstances and operational demands given that resorting solely to outdated value assessments based upon historical purchasing data through LIFO could complicate maintaining accurate ledger accounts reflecting balances pertaining directly to inventories held.

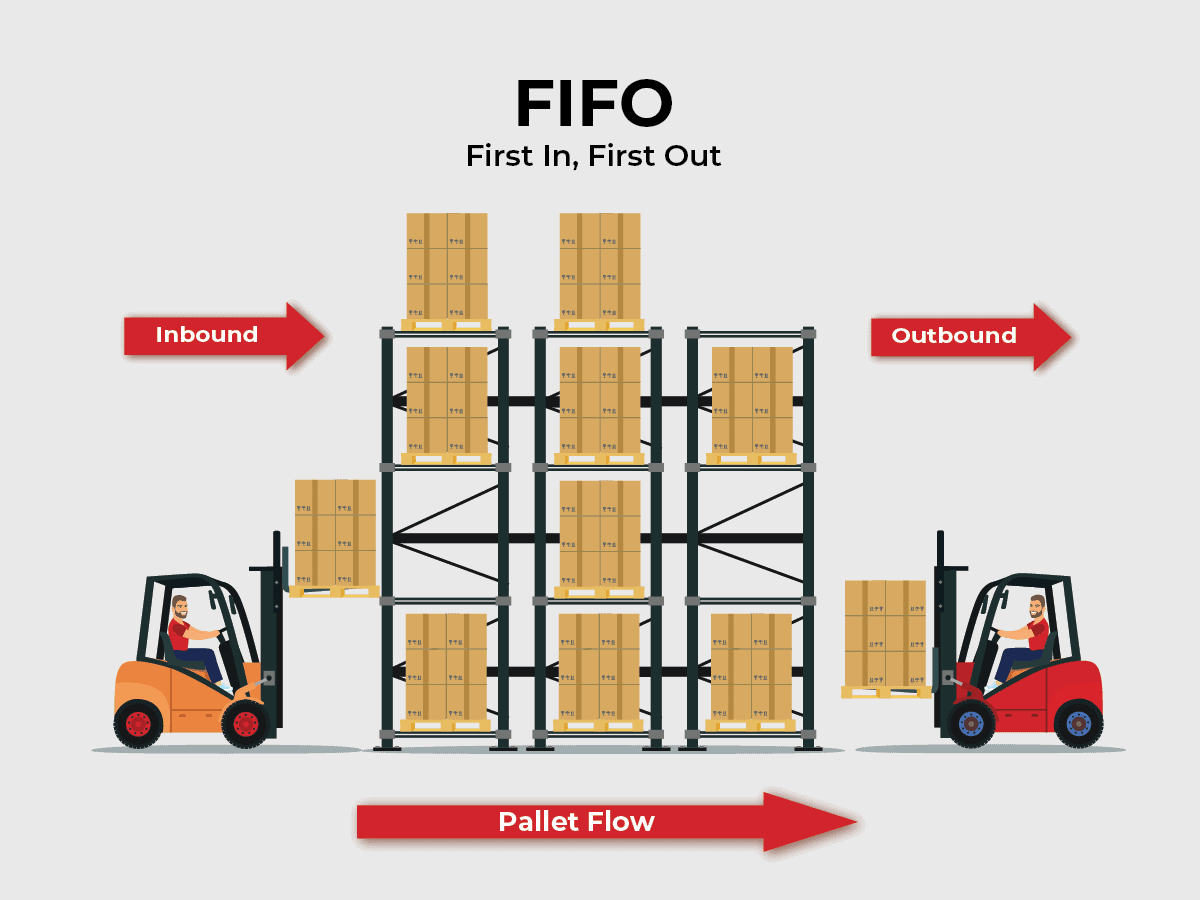

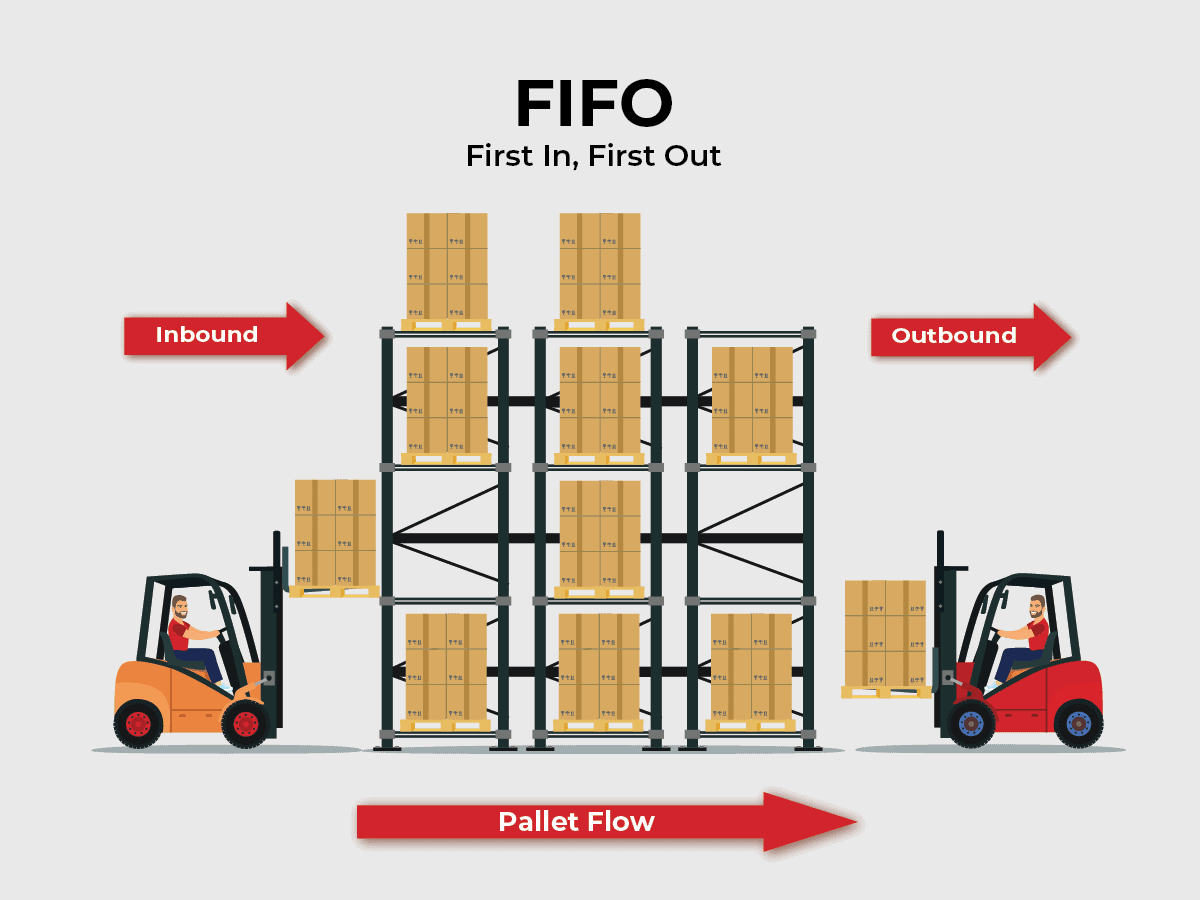

LIFO vs FIFO: A Comparative Analysis

LIFO (Last In, First Out) and FIFO (First In, First Out) are two key inventory valuation methods with distinct approaches that have significant financial consequences. FIFO operates under the assumption that items from the oldest inventory stock are sold first, whereas LIFO implies selling off newly acquired inventory before older goods. Such differences notably affect a company’s finances during times of inflation.

Commonly adopted by businesses for its reliability, the FIFO method tends to increase ending inventory value as it better mirrors current market prices for remaining inventory items. On the other hand, employing LIFO can result in reduced taxable income due to elevated Cost of Goods Sold (COGS), which consequently diminishes net income. This reduction may benefit companies aiming to lower their tax burden despite leading to decreased profits on paper compared with using FIFO where end-of-period inventories might be assessed at higher values indicating inconsistencies when applied alongside LIFO.

Companies sometimes favor LIFO over FIFO, especially when experiencing rising costs related to their inventories. This preference should also consider corporate objectives regarding taxes and prevailing economic contexts.

A thorough comprehension of both these valuation methods empowers firms to decide strategically based on what best suits their broader fiscal plans.

Calculating Inventory Costs Using LIFO

Utilizing the LIFO method necessitates a structured process for calculating inventory costs to ensure both precision and adherence to accounting standards. With this approach, it’s essential that businesses use costs from their most recent inventory purchases when determining the cost of goods sold (COGS), which has implications for profitability. Maintaining detailed records of these latest inventory expenses is crucial for proper application of the LIFO technique.

For example, if a retailer specializing in stationery sells 200 pens, employing the LIFO method would result in attributing a COGS of $500 based on recently acquired stock prices. In another case where 350 items are sold by an enterprise, adopting LIFO could reveal total COGS amounting to $1,700. These instances highlight how applying higher costs to goods recently sold is intrinsic to using this particular methodology.

Advanced software designed for handling inventory tasks can substantially streamline computing these specific overheads under LIFO rules. Such systems aid in meticulously monitoring newer stock acquisitions and precisely allocating expenditures related to sales transactions—facilitating exact and systematic implementation of lifo-based accounting practices while simultaneously reducing potential inaccuracies and improving overall management strategies concerning inventories.

Benefits of Using the LIFO Method

Under conditions of escalating prices, LIFO (Last-In, First-Out) accounting presents several compelling advantages. By pairing recent inventory costs with present-day sales revenue, it provides a more precise portrayal of profit margins during times of inflation. This method ensures that expenses are synchronized with the prevailing market dynamics.

LIFO can lead to significant tax relief opportunities. As prices increase, adopting this approach often elevates the cost of goods sold on financial statements. Consequently, there is a decrease in taxable income which may result in lower tax payments—a strategy that’s beneficial for businesses striving to improve their fiscal outcomes and lighten their tax loads.

For sectors such as grocery chains and drugstores where inventory costs tend to climb regularly, embracing LIFO can be particularly useful. It helps sidestep reductions in stock value while aligning outlays with revenue from goods sold—thus equipping companies with an effective tool for managing economic reports and reinforcing overall business efficacy.

Drawbacks of the LIFO Method

The LIFO (Last In, First Out) inventory valuation method has several disadvantages that companies need to weigh carefully. One significant concern is the distortion it can cause in the reported value of inventory on a company’s balance sheet. During times when prices are rising, LIFO might result in older stock being undervalued if compared to more recent market prices, leading to an inaccurate representation of a firm’s actual assets and causing inconsistencies within financial statements.

Another issue with using the LIFO approach is its influence on net income—specifically its tendency to decrease profits as reported because it increases the cost associated with goods sold. This reduction could potentially dissatisfy investors and negatively impact how a company’s performance is viewed in securities exchanges due to heightened administrative demands for precise record-keeping under this system.

Organizations operating internationally must take note that LIFO does not align with International Financial Reporting Standards (IFRS), making it incompatible for firms required to adhere to diverse accounting regulations across borders. The exclusion from IFRS primarily relates concerns around tax avoidance through reduced taxable earnings and misrepresentation stemming from skewed methods of determining inventory values. Thus, urging enterprises considering various approaches towards appraising their stockpile valuations should proceed judiciously.

Legal Considerations for LIFO

In the United States, the legal context of utilizing the LIFO method is predominantly dictated by Accepted accounting principles (GAAP). Under GAAP, U.S. public companies are authorized to employ LIFO, which acknowledges its efficacious role in financial reporting. Entities must apply LIFO consistently to prevent scrutiny from regulatory bodies and complications related to their financial statements.

A crucial aspect of legality involves IFRS’s ban on using LIFO because it results in providing outdated data and poorer quality evaluations on balance sheets. Given that IFRS does not allow for this inventory accounting practice, multinational corporations face challenges adhering to diverse sets of accounting standards across different jurisdictions.

To implement a transition towards using the LIFO approach within an organization’s operations, gaining approval from IRS is mandatory along with compliance with certain prescribed procedures. One must file Form 970 and refrain from making such a change during an ongoing accounting period. These mandates highlight the significance for companies to be well-informed about legal implications preceding any decisions pertaining to embracing or altering adherence to specific accepted accounting principles GAAP related practices like LIFO.

Practical Example of LIFO in Action

Imagine a company possessing an inventory of 10 widgets, where half are priced at $100 apiece and the rest at $200 each. When employing the LIFO method to account for selling seven widgets, it results in recording a cost of goods sold totaling $1,200 because it considers the higher prices associated with more recently acquired inventory first.

When businesses opt for utilizing the LIFO method as part of their inventory management strategy, they ensure that recent market price increases reflect appropriately on their financial statements. This approach to accounting offers an accurate depiction of costs during times when inflation affects prices, showcasing how applying the LIFO principle can significantly impact both reported earnings from goods sold and evaluations of remaining stock.

Leveraging Technology for LIFO Inventory Management

In today’s business environment, it is essential to harness technology for successful management of inventory using the LIFO method. Software dedicated to managing inventory significantly contributes by accurately monitoring both remaining stock levels and associated costs with precision and swiftness. This software facilitates automatic computation of costs pertaining to inventory under the LIFO system by prioritizing the alignment of freshly acquired inventory against sales revenue.

By employing these advanced tools in their operations, companies can precisely attribute expenses tied to their most recent purchases—streamlining the process behind lifo accounting. As a result, potential errors due to human involvement are minimized, enhancing practices in handling inventoried goods. The end goal is an improvement in financial outcomes and an increase in efficiency concerning operational expenses related to inventories.

Summary

Effective inventory management is essential for the thriving of businesses, with the LIFO (Last-In, First-Out) method serving as a key strategy during times of inflation. This technique matches current revenues with elevated costs and can affect financial reporting while offering tax benefits. Nevertheless, it might lead to inaccuracies in balance sheet representations and encounter restrictions on an international scale.

Comprehending both the positive aspects and limitations of LIFO, along with its legal implications and operational uses, is vital for companies seeking to make well-informed choices. The incorporation of modern technology can refine inventory management using LIFO by promoting precision and streamlining processes. Adopting the LIFO method could be instrumental in enhancing inventory procedures toward fiscal proficiency.

Frequently Asked Questions

What is the LIFO method?

The LIFO (Last In First Out) method is an inventory valuation approach that dictates the most recently purchased goods are sold first, significantly affecting the cost of goods sold and financial statements.

This method can lead to tax benefits during periods of inflation.

How does LIFO affect financial reporting?

LIFO affects financial reporting by increasing the cost of goods sold and reducing net income, particularly during inflation, which can result in lower tax liabilities.

Additionally, it influences the balance sheet by reflecting older inventory values.

What are the benefits of using the LIFO method?

Utilizing the LIFO method effectively aligns higher costs with current revenues, resulting in tax savings and offering advantages for industries experiencing rising inventory costs.

This can lead to enhanced financial outcomes for businesses in such sectors.

What are the drawbacks of the LIFO method?

The LIFO method can distort inventory values and lead to lower reported profits, as well as being disallowed under international financial reporting standards (IFRS).

These drawbacks can affect a company’s financial reporting and comparability.

How can technology help with LIFO inventory management?

Technology can significantly enhance LIFO inventory management through the use of inventory management software, which automates cost calculations and ensures precise tracking of recent purchases.

This leads to improved accuracy in LIFO accounting processes.